Oil Price Increases

Brent crude price increased from $81.75/barrel (b) on 7 January 2022 to a peak of $127/b on 8 March 2022. It fell to about $101.07/b on 6 April 2022 following the news of supply side measures such as release of crude from Strategic Petroleum Reserves (SPR) in developed countries. Brent crude prices on 6 April 2022 were over 50 percent higher than prices in April 2021. Though post pandemic recovery is among reasons for growth in oil demand, oil price increases have been driven mostly by sanctions on Russian oil imports since March 2022. Russia is the third largest oil producer and the largest exporter. Its exports of about 5 million barrels/day (mb/d) of crude representing roughly 12 percent of global trade. Russia also exports approximately 2.85 mb/d of petroleum products that represents around 15 percent of global refined product trade. Around 60 percent of Russia’s oil exports go to Europe and another 20 percent to China. In 2021, imports from Russia accounted for 8 percent of all US petroleum imports, consisting of 3 percent share of crude oil imports and 20 percent share of petroleum product imports.

The increases in prices are being felt everywhere. Even though crude prices are yet to hit levels seen in 2008, currency exchange rates along with taxes imposed on petroleum products have taken the retail price of petroleum products to record high levels. According to the IEA (International Energy Agency), monthly spending on oil products for transport and heating increased by more than $40 per household (nearly 35 percent) in developed countries and by nearly $20 per household (nearly 55 percent) in developing countries. In the United States, where increase in retail price of petrol affects political sentiment strongly, the average retail price of petrol has increased from less than $2.5/gallon (₹50.13/litre) in January 2021 to more than $4/per gallon (about ₹80.21/litre) in March 2022. In India the retail price of petrol has crossed the psychological barrier ₹100/litre in many parts of the country sparking protests.

Supply Side Measures

Increase in supply is one of the many means to address the problem of high oil prices. Coordinated release of SPR by developed countries that have the largest reserves, increase in supply from OPEC (oil producing and exporting countries), increase in supply from non-OPEC countries, increase in supply from Iran following relief from sanctions are among supply side measures that are being considered. On 1 March 2022, 31 member countries of the IEA agreed to release 60 million barrels of oil from their emergency reserves to send a message to global oil markets that there will be no shortfall in supplies as a result of the sanctions on Russia. In the last week of March 2022, the United States announced that it will release 1 mb/d of crude oil from the SPR from May 2022 that will continue for six months totalling 180 million barrels. Following the announcement of SPR release from the USA, Brent crude futures for May, fell by about $5.54/b or 4.8 percent $107.91 a barrel. The IEA members agreed to release 120 mb/d of SPR crude on 7April 2022. This will include 60 mb/d of crude from the release of 180 mb/d announced by the US earlier. In total IEA member countries and the USA will release 240 mb/d of their SPRs.

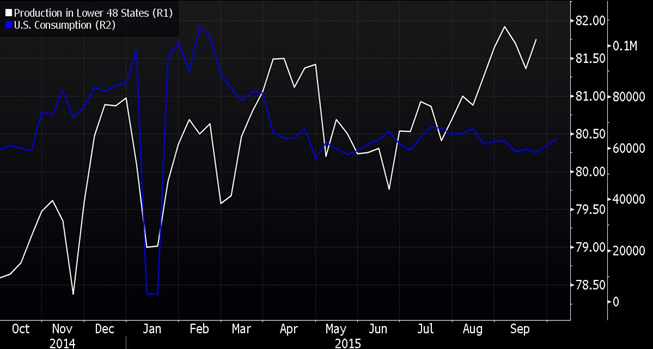

The announcement of the US SPR release, described as the biggest in history, was made on the same day OPEC decided to increase production by 400,000 b/d. But given that OPEC decisions are informed more by geopolitical concerns than by market fundamentals it is unlikely that OPEC will increase supply substantially. Moreover it is not certain that OPEC countries have spare capacity to ramp up production as most have not been able to meet existing targets. If sanctions against Iran are relaxed there is a possibility that it can make a significant contribution to supply later in the year. There is also the possibility of increase in oil production from US shale plays but so far, the expectation that oil production from US shale producers can be ramped up and down rapidly depending on market forces has proved to be inaccurate.

Demand Side Measures

In response to the increase in oil prices, the IEA has come out with a ten-point recommendation to reduce oil demand in advanced economies that account for 45 percent of oil demand. The recommendations are (1) reduce driving speed on highways by 10km/h (2) work from home for up to 3 days (3) make Sundays car free (4) use cheaper public transport (5) reduce traffic by alternating between odd and even number plated vehicles (6) increase car sharing (7) increase efficiency of freight transport (8) encourage faster adoption of electric vehicles (9) avoid business travel (10) use highspeed overnight trains instead of planes.

According to the IEA, these ten measures, if implemented successfully, will reduce oil demand by 2.7 mb/d within 4 months and reduce the pressure on oil prices. The long-term objective of this programme is to engineer structural decline in oil demand that will put advanced countries on a secure path to net-zero.

Challenges

While both oil supply increase and oil demand decrease are necessary to address the problem of high oil prices, they are not as straightforward to implement as they sound. Announcement of SPR release may not always result in decreasing the price of crude oil. Following the announcement by the IEA that 2mb/d of oil will be released over 30 days on 1 March 2022, the price of Brent crude increased by 4 percent from $101.06/b to $104.97/b reflecting concerns over the size of the release as well as doubts over the capacity to release crude as stated. In November 2021, the US government announced release of 50 mb/d of crude from mid-December, but crude prices increased by $11.2/b or 15 percent and the US released only 20 mb/d of crude. Analytical studies show that the effect of SPR release on prices have been modest. The cumulative effect of the SPR releases after the invasion of Kuwait in 1990 was a reduction of $2/b in the real price of oil after 7 months. Even if there is a reduction in oil prices in the short term, SPR release tend to increase the real price of oil in the longer term. SPR drawdowns contribute to higher demand expectations and higher price in the longer term when reserves are replenished. Studies on the Chinese domestic oil market response show that the effects of the SPR on suppressing domestic oil price are small in all scenarios. Focussing on the demand side of the market could be counterproductive to efforts of reviving the global economy after the pandemic. The IEA recommendations are addressed to OECD (organisation for economic cooperation and development) countries but accelerated growth in non-OECD countries that account for 54 percent of oil demand may offset the effect of a decrease in oil consumption in OECD countries. The IEA recommendation to shift mobility to efficient alternatives, if successful, will depress industries such as aviation contributing to job losses. As demonstrated by the pandemic, national economies may not want to pay the price of job losses to keep oil prices down. Loss of tax revenue from oil consumption may also affect government spending plans in OECD countries that collect substantial revenue from high taxes on oil consumption. History shows that curbs on oil demand are rarely popular and increase in supply take time. In the short term, there are few solutions to the problem of high oil prices that do not upset lifestyles for the rich and livelihoods for the poor.